Media

Key highlights, industry news, insights, and expertise around the world of logistics

The future of GCC's road freight sector - growth drivers and stoppers

Trucking is the leading freight transportation mode in the world with 70% of goods being shipped by road, according to Roland Berger. In 2020, the global road freight industry was valued at around $3.1 trillion in 2020, due to a Frost & Sullivan white paper. The market has grown continuously owing to the increasing levels of trade and economic activity. The COVID-19 outbreak marked the first time in a decade that activity in the sector decreased caused by travel restrictions, border closures, and lockdowns. Those drastic precautions have obviously impacted freight capacity and flow of goods with estimates suggesting a decline of between 15% and 25%, depending on the market.

The sector’s global revenues are forecasted to grow by an average of 4.3% annually from 2020 to 2025. Looking at a regional level, the growth forecast for the Africa & Middle East region is estimated at 3.9%. Another source predicts the transport sector in the Gulf Cooperation Council (GCC) to grow by a CAGR of 5% between 2020 and 2025.

But which aspects will drive this growth in the GCC region and are there challenges which could possibly slow down the upwards development when not addressed in the right way?

In this article, we will look at the current road freight market in the GCC and some of its potential growth drivers. Then we will identify the risks the industry should be aware of to avoid staying behind the expectations and international competition.

The road freight market in the GCC region

As it is the case globally, in GCC’s regional logistics market the road freight mode holds the largest share. Today, practically all land cargo within the region is shipped by road freight carriers. More than one million trucks are in operation, a number that increases by 5 to 9% each year. One reason is that truck transport is relatively cheap compared to other modes, mainly due to Government fuel subsidies reducing gasoline costs by at least 20% — one of the largest expenses of trucking companies, according to Strategy&.

Market share by types of road freight transport

In terms of the types of road freight transport available in the GCC region, the full truck load (FTL) and less than truck load (LTL) segments currently constitute almost half of the total road freight logistics market and will continue to rise due to the region's strategic position and its free trade zones and economic cities. FTL constitutes the major share in the GCC road freight segment at 30% owing to high volume and large ticket size of orders and consignments.

Potential growth drivers of GCC’s road freight sector

Infrastructure

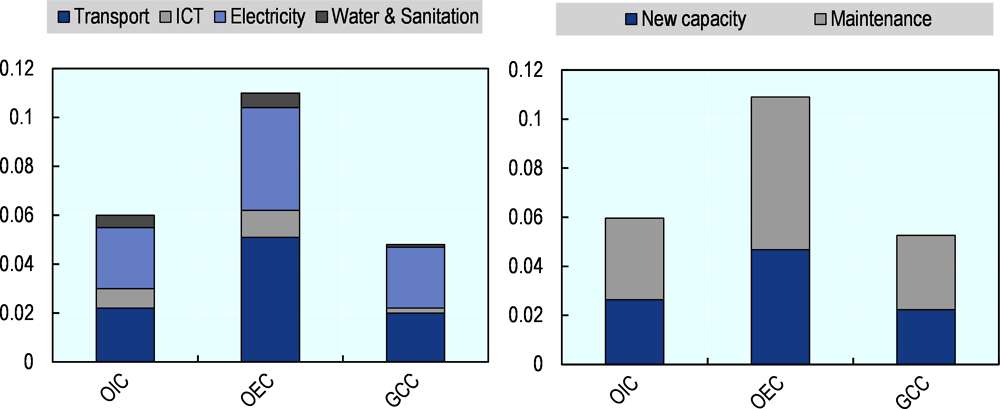

One of the road freight sector’s challenges has been the region’s low density of the road network. The performance of road transport infrastructure remains low, causing delays and raising the cost of trade. According to the World Bank, the GCC region needs to invest approximately 5% of their GDP in infrastructure investments. The gaps are particularly prevalent in cross-border infrastructure and road transport. Governments of the GCC countries have recognized that high-quality infrastructure is a crucial driver of sustainable growth and committed to significantly invest and improve the region’s infrastructure enhancing connectivity and boosting trade. Hence, as a report from 2019 by Orient Planet Research shows, the GCC countries have a large pipeline of road infrastructure development initiatives with roads, highways, and bridges being among the highest number of projects.

Annual infrastructure investment needs in MENA

Source:

World Bank estimations

Intra-GCC trade growth

The GCC countries with their 58 million people rank 13th among the world's largest economies with a GDP of $1.64 trillion in 2019, due to albawaba News. Prior to COVID-19, it was predicted that the region could become the sixth-largest economy in the world by 2030 given the union’s tremendous capabilities and strong energy and trade sectors. However, the spread of the pandemic caused a halt to economic activities and growth. But the way ahead is clear, the Gulf states wish to preserve pre-pandemic gains and ensure their continued growth and will work closely together with public and private sectors to encourage more trade between GCC countries. In addition, intra-GCC trade will further benefit from the rapidly growing cross-border e-commerce sector across the entire MENA region boosting the need for road freight services across the region, as a report by Bain & Company clearly reveals.

Gross domestic product (GDP) projection to 2030