Media

MENA’s e-commerce market on fast track – Why Chinese e-commerce sellers should not miss out

The importance of China to the Middle East and North Africa (MENA) region cannot be underestimated. Imports from China were worth US$146bn and exports worth US$169bn in 2018 growing exponentially since 2003 according to MENA: Trade briefing. China is both MENA’s top import and export partner. MENA’s trade with China is twice the size of trade with its second largest country-level export partner, the US.

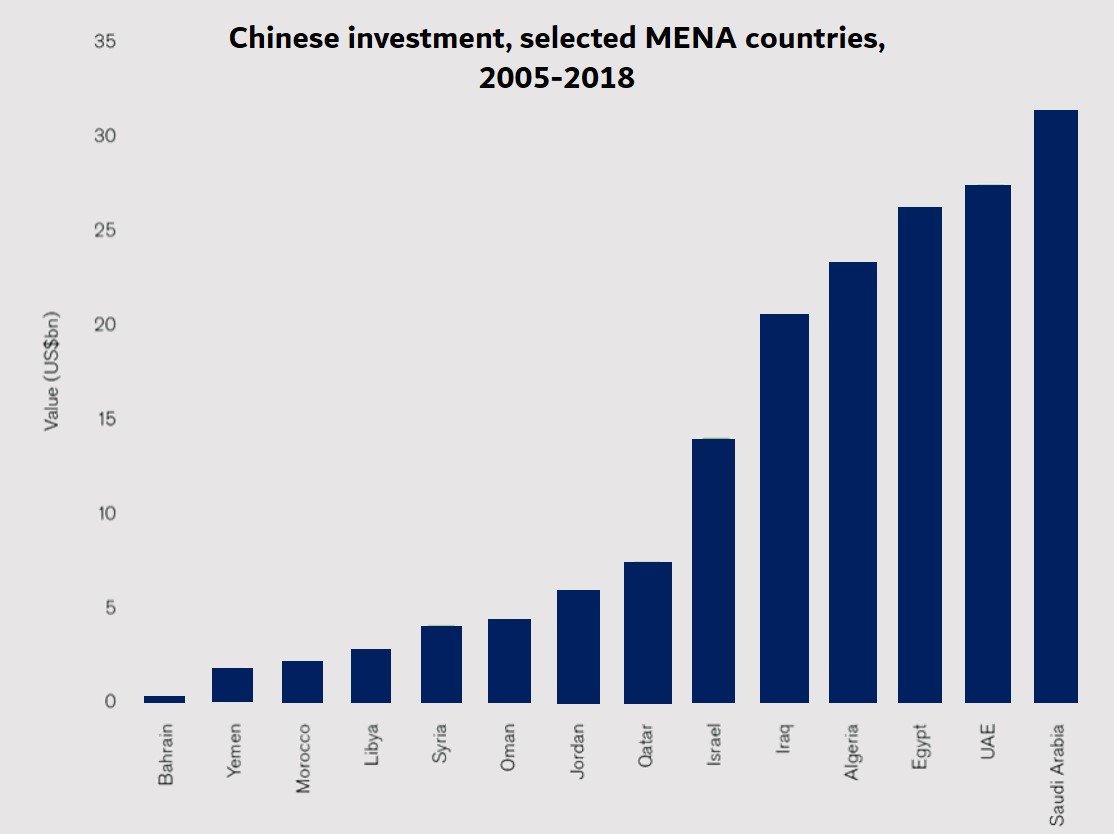

Moreover, China has immensely increased its investment in the region since 2005 and is now the largest investor with a particular focus on Saudi Arabia, the United Arab Emirates (UAE), Egypt, and Algeria. Main areas of investment have been infrastructure, the energy sector, construction, finance, and real-estate.

Source: MENA: Trade Briefing

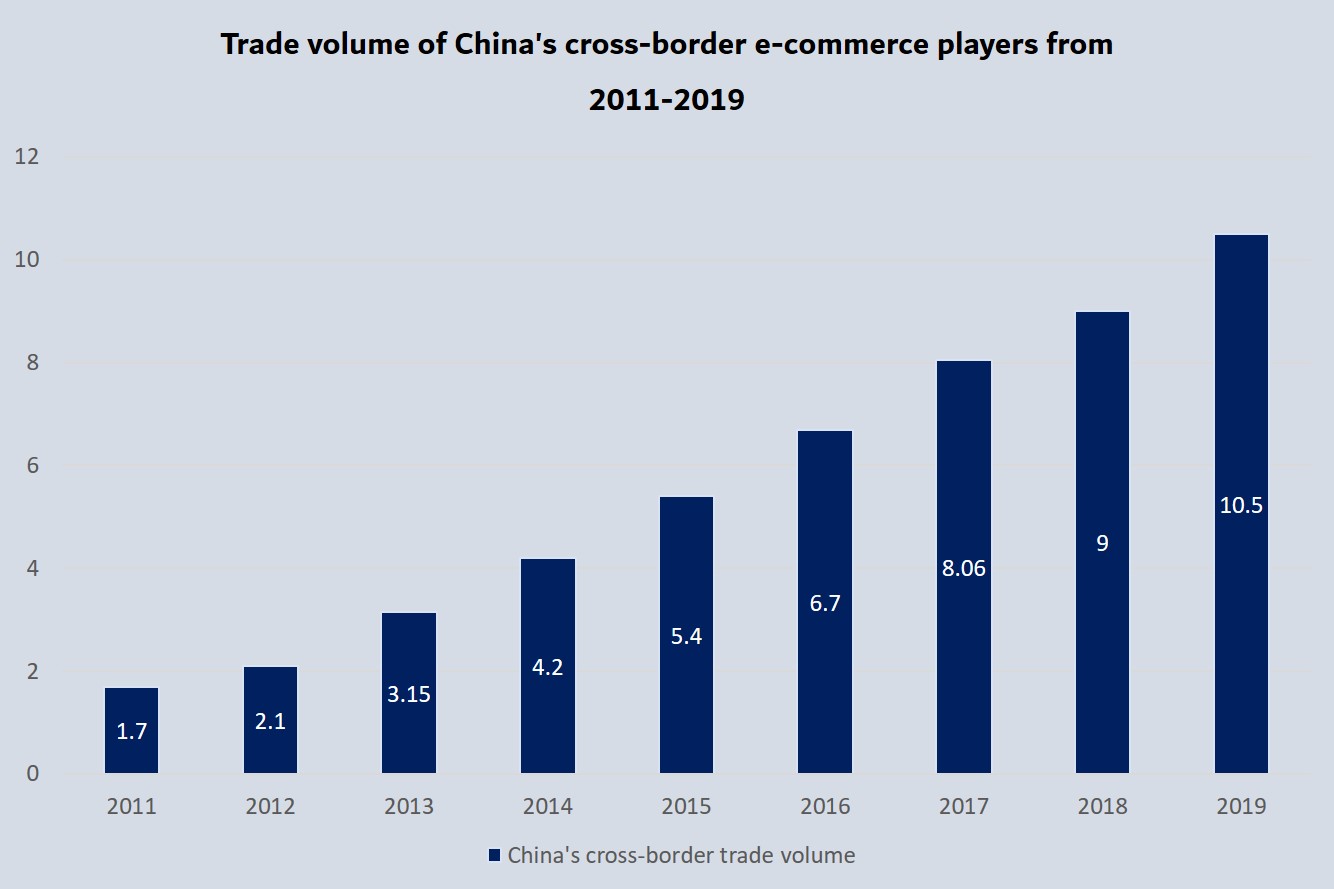

The tendency of tightening China-MENA relations will most likely continue as in recent years more sectors have been increasingly attracting Chinese investors and companies. For example, the presence of Chinese private sector companies, especially technology firms, can be observed as the World Economic Forum confirms. With high internet penetration surpassing 70% in the Middle East, Chinese venture capitalists (VC) and angel investors are starting to spread across the GCC and North Africa. They are interested in entertainment, leisure, technology, logistics, fintech and e-commerce. Trade volume of China’s cross-border e-commerce sector, for example, has been seeing skyrocketing growth in recent year which is why Chinese e-commerce companies are looking to further expand their reach.

Source: Statistika

Five Chinese players belong to the top e-commerce platforms in the MENA region – Alibaba, Club Factory, SHEIN, ROMWE, and JollyChic. They are drawn by the growing size of the MENA e-commerce market, which is expected to reach $49 billion by 2022, as a report by Visa states. JollyChic has even become one of the largest regions’ e-commerce sites, focusing on cross-border trade as manufacturing is rarely based in the Middle Eastern oil-producing countries such as Saudi Arabia and the UAE which therefore largely depend on imports of daily necessities from abroad due to China Daily. This shows the huge potential for imported Chinese products which have the reputation in the Middle East of being cheap and high in quality.

Thus, this article looks at the opportunities the MENA e-commerce market has to offer to Chinese, and foreign e-commerce sellers in general, and which marketplaces can be explored by foreign sellers. It further points out the challenges e-commerce companies might face when entering the market and makes suggestions on how those huddles can be managed in order to facilitate a smooth market entry.

The potential of MENA’s e-commerce market

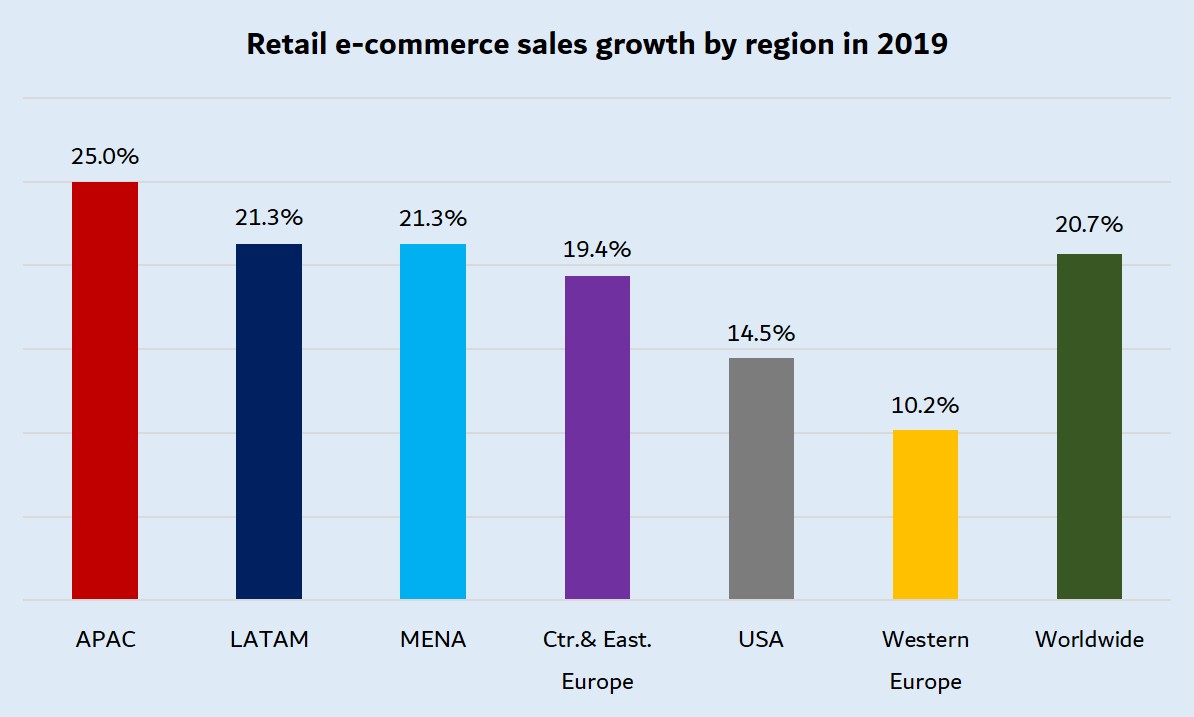

Today, the three fastest growing regions in terms of e-commerce are Asia Pacific (APAC: 25% yoy), Latin America (21.3% yoy) and Middle East & Africa (MENA – 21.3% yoy).

Source: eMarketer

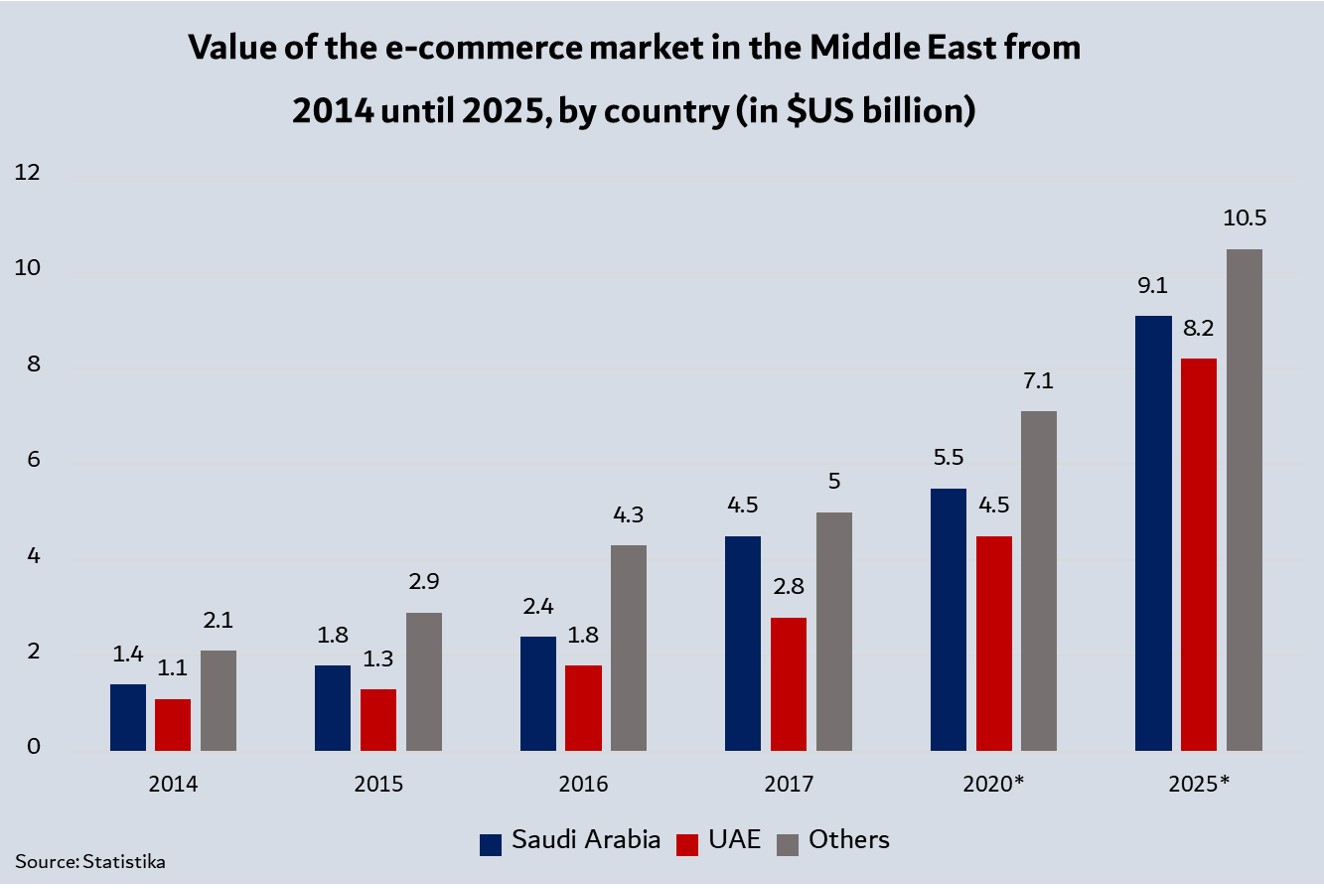

The total MENA market size, including all categories, has been forecasted to be worth US$49 billion in 2022, up from $27 billion in 2018 due to Visa’s report. Interestingly, even though the growth figures are skyrocketing, online sales in MENA still only equal 2-3% of total retail revenue with the UAE being the most advanced e-commerce market having a penetration rate of 4.2%, followed by the Kingdom of Saudi Arabia (KSA) at 3.8%, and Egypt at 2.5%, due to Go-Gulf. On the other hand, the UAE and KSA have some of the highest levels of internet, smart phone, and social media penetrations globally, while Egypt has one of the highest levels of time spent online. Furthermore, the UAE hosts one of the highest spending online community willing to shop online for an average amount of US$450 annually.

Hence, given the fast growth of e-commerce in MENA but its relatively low retail market share paired with the region’s high internet penetration rate, the potential of e-commerce in MENA is obvious. Digital savviness will logically boost e-commerce activities as people frequently using the internet regularly amplify their areas of usage. On top of that, the shift towards online has experienced a sharp boost due to the global outbreak of the corona virus (COVID-19). Many consumers changed their shopping behavior during the pandemic, as a regional study including 10 MENA countries shows. Up to 40% of the respondents said they shop online more often than before the COVID-19 outbreak. And 48% in the UAE and 69% in KSA replied they would maintain their current shopping behaviors after the pandemic.

Most potential e-commerce markets in the region: UAE, Saudi Arabia, and Egypt

UAE’s e-commerce market

UAE’s e-commerce market is the most dynamic market across the MENA region, as well as the e-commerce leader among GCC states. Overall, the market has been growing at an average rate of 25% per year from 2017 to 2020. The share of mobile use in regular online purchases (47%) is already higher than laptops and desk computers (39%). Cross-border shopping is extremely popular in the UAE, with 46% of consumers having purchased from foreign websites in 2017. American websites were the most visited e-commerce platforms, followed by Indian and Chinese websites. Souq.com, cobone.com and noon.com launched by real-estate developer Emaar Group in 2017 are the largest locally based e-commerce websites. The acquisition of Souq.com by Amazon has been further boosting UAE’s e-commerce market. While online sales have been traditionally dominated by electronics retail, the share of fashion is accelerating and grew from US$ 85 million in 2013 to US$ 272 million in 2017, according to Societe Generale.

Saudi Arabia’s e-commerce market

Saudi’s e-commerce market has been steadily growing with turnover increasing by 11% on average, due to Societe Generale. Total e-commerce revenue across all product categories was US$ 6.13 billion in 2017 and is expected to grow to US$ 9.41 billion by 2021. The market, with its 12.94 million users (50% of all internet users), is one of the largest across the MENA region. By 2022, the number of users is expected to increase to 19.28 million users (accounting for 54% of total population). With this development, Saudi Arabia is set to surpass the UAE as the top e-commerce market in the Middle East at some point. Cross-border trade is also significant with UAE-based websites leading international shipments to Saudi Arabia. 65% of all online purchases were made from websites based in GCC countries. Noon.com launched a local version of its website in Saudi Arabia at the end of 2017 significantly contributing to the share of domestic online shopping. Souq.com (purchased by Amazon), Amazon Global (US), Aliexpress and Jollychic (both China) are among the most visited e-commerce websites in Saudi Arabia. Fashion products lead online sales in Saudi Arabia with a grow rate of 20% between 2018 and 2021. The footwear segment is forecast to have the highest growth (28.3%) within the fashion market during this period.

Egypt’s e-commerce market

Egypt is the third most populated country in Africa with its 99.3 million inhabitants and has recorded a tremendous growth in internet penetration rates in recent years. The number of internet users accounts for 50% of the population. That is why the Egyptian e-commerce market is booming and set to be the largest in Africa. As a country at a crossroads between the Arab world and Africa, both pan-Arab and pan-African e-commerce websites are popular in Egypt. As such, the local edition of the Pan-Arab general retailer Souq is among the most popular websites in the country as is the Pan-African general retailer Jumia. Lynks and Eshtereely, which enjoy growing market shares, work as intermediary websites, handling the delivery of products that are ordered through international marketplaces, including Amazon and eBay. However, e-commerce only accounts for 0.4% of retail sales in the country. Mobile phones were by far the most popular product among online shoppers in 2017 (61%), followed by laptops (37%) and clothes (34%).

Source: Statistika

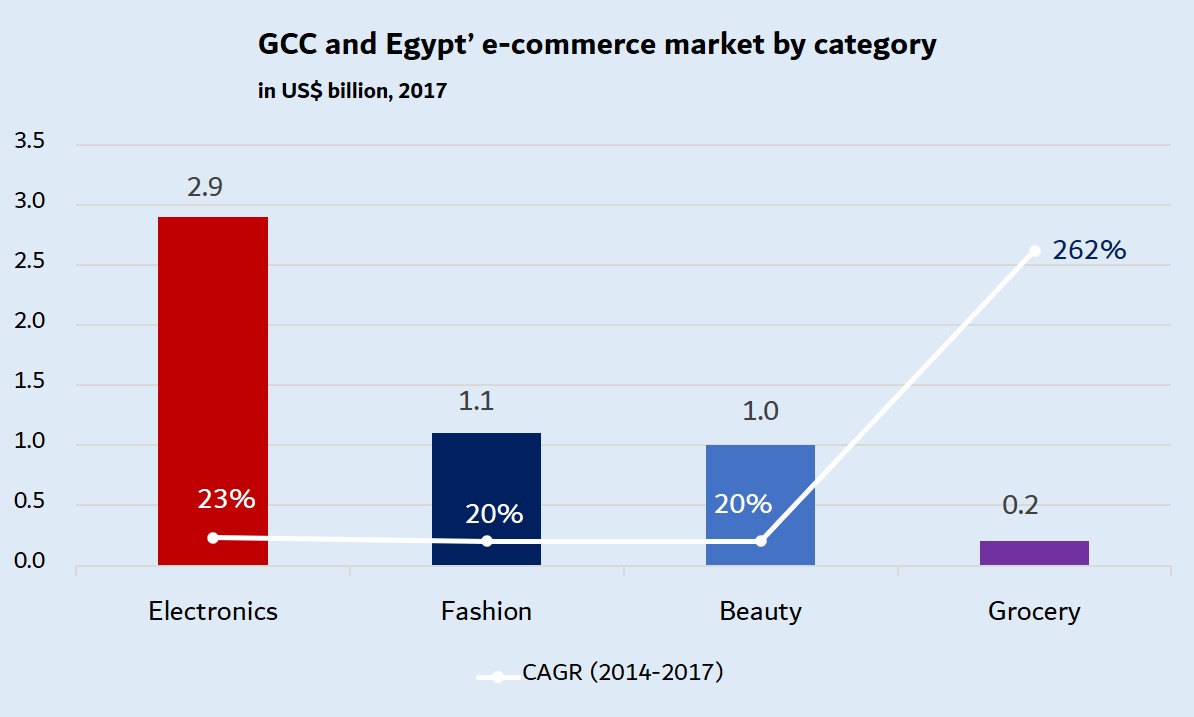

Most popular e-commerce segments

For MENA it stands out that electronics, fashion, beauty, and grocery comprise 80% of the e-commerce market with significant room for growth across all categories when comparing to mature e-commerce markets, according to Go Gulf. At US$ 2.9 billion and an annual growth rate of 23% over recent years, electronics is the largest e-commerce category in GCC and Egypt. Beauty/personal care is the second highest penetrated category with an e-commerce market size of around $1 billion and a growth rate of 20% in GCC and Egypt. But while electronics and beauty/personal care have penetration levels like those seen in developed markets, fashion, and grocery lack behind. However, grocery is the fastest-growing e-commerce category worth $200 million (<1% of ecommerce market) in GCC and Egypt and has been growing at 250% during recent years.

Source: Brain & Company

Opportunities for Chinese retailers and e-commerce players looking to enter the MENA market are numerous. For example, studies show that only less than 20% of top global fashion brands physically present in MENA have locally based e-commerce platforms that offer delivery to the regional consumer. As a result, imports to the GCC region remain high due to a supply gap of popular products. Also, the existing offline retail businesses in the region have not been very active in exploring the online potential. Some estimates suggest that only 15-20% of brick-and-mortar Middle Eastern chains have online fronts. This demand-supply imbalance creates opportunities for cross-border e-commerce players being based outside MENA, currently representing around 45% of the market in the GCC. As the success story of JollyChic shows, Chinese products are popular in the Middle East. They are attractive in terms of selection, quality, and price.

Most popular e-commerce platforms in MENA and how to get started

Registration on all major e-commerce MENA marketplaces, which mostly cater to the markets of UAE, Saudi Arabia, Oman, Bahrain, Kuwait, and Qatar, is for free. Sellers usually need a bank account, a trade license, a verified email address and a business location to be enabled to sell their products. All platforms charge a commission fee per item sold which vary depending on the marketplace.

Let’s Tango

Let’s Tango is another marketplace that promises you a good exposure in the Middle Eastern e-commerce landscape selling across all Arab states in the Persian Gulf except for Iraq. It is primarily known for electronics, mobile gadgets, household goods, fashion & beauty, and computers. A 10% commission must be paid on every item sold.

Jollychic

The Chinese platform JollyChic has become a leading e-commerce marketplace in the MENA region selling electronic appliances, apparel, and a range of consumer goods. The platform has extended its services to European countries providing sellers a wider market. Commission fee per item sold is 15%.

Easy Shopping

As the name suggests, this free e-commerce marketplace has one of the most user-friendly interfaces to work with. It is convenient for placing jewelry items, watches, home appliances, fashion, and electronics & digital devices.

Cobone

Cobone is one of the most established e-commerce marketplaces in the Middle East. The website deals with both services and products offering daily deals in food, activities, beauty, wellness, and services. Cobone successfully supports sellers with their marketing campaigns. Commission fee is 15% to get referrals.

Namshi

Namshi is an online e-commerce site offering footwear and apparel fashion brands. The commission paid on each sale and another on each iOS or Android application download. The sale commission is a percentage per sale and differs from 12-16% depending on the market.

Amazon(Souq)

Souq, acquired by Amazon in 2017, is the largest e-commerce platform in the Middle East covering the entire Arab world offering general merchandise, including fashion, electronics & accessories, mobile & tablets, appliances, home & kitchen. Souq charges 5% to 20% commission fee per item sold.

Ounass

Ounass.ae is one of the region’s most premier shopping websites exclusively dealing in women’s clothing, shoes, bags, accessories, and jewellery. The unique aspect of Ounass is that they are offering international luxury brands such as Gucci, Dolce, and Gabbana, Valentino and Kiehl's.

Jumia

Jumia is a leading e-commerce platform in Africa, also offering logistics and payment services facilitating transactions among participants active on Jumia's platform in selected markets. You can list any product if it complies with the company's terms and conditions.

Noon

Though not as big as Amazon, Noon.com also offers a holistic selling mechanism. Its Seller Lab allows sellers to benefit from the extensive network of the company, particularly in the UAE, to sell products. Noon is best for an assortment of products including fashion, electronics, home & kitchen, and beauty. However, with 30% the commission fee per item sold is high.

Main challenges for cross-border ecommerce players

Once Chinese sellers have decided to enter the MENA e-commerce sector, many aspects need to be considered to build a successful business. One of them is the set-up of an efficient logistics infrastructure. This is crucial to any e-retailer’s success as customers request to receive their orders within short periods. Moving products at high speed across borders requires solid supply chain management. Companies with inefficient supply chains can expect to lose business. Here are some of the challenges cross-border e-commerce companies should be aware of before entering the MENA region.

Customs clearance – Customs processes in the Middle East are a bureaucratic huddle for online retailers. If overseas retailers importing to MENA are not prepared, it can take weeks to clear customs. For example, different states require different documentation which can vary from six documents in the UAE to 12 in Saudi Arabia. Cargo shipments crossing multiple land borders within the GCC region might have to undergo physical inspections by customs at each border crossing even though there is a customs union in place. Another challenge is a missing standardization of import licensing and permissions. A product that may be imported freely into one GCC customs union member state might require a permit or license in another. To tackle those challenges, it is highly recommended to work with an import/logistics partner with proven expertise in local customs clearance. They are aware of latest customs related requirements and updates and will help you to bring your cargo seamlessly through customs.

Fulfilment in local markets – Some of the more established e-commerce players such as JollyChic have been investing in their own logistics infrastructure in MENA to ensure efficient inventory management and fast deliveries. However, this requires time and resources many of the smaller and mid-sized e-commerce players do not have. That is why Chinese sellers without own facilities in the Middle East depend on professional logistics partners who import their products from China to MENA – usually to the UAE, from where the products are further distributed to other markets in the region. If sellers use Amazon or Noon as marketplace, they can benefit from integrated fulfilment services which include in-house storage and last-mile distribution. But those services are limited to local markets such as UAE and KSA and do not exceed borders. So, if a seller supplies diverse markets in the MENA region, an external logistics partner with a regional network is required to guarantee seamless cross-border fulfilment and last mile delivery. However, there are not many logistics players with the needed experience and set-up to cater to the rapid speed and complexity of cross-border e-commerce fulfillment. Consequently, the logistics strategy a cross-border seller will pursue in MENA, needs careful planning and consideration in advance.

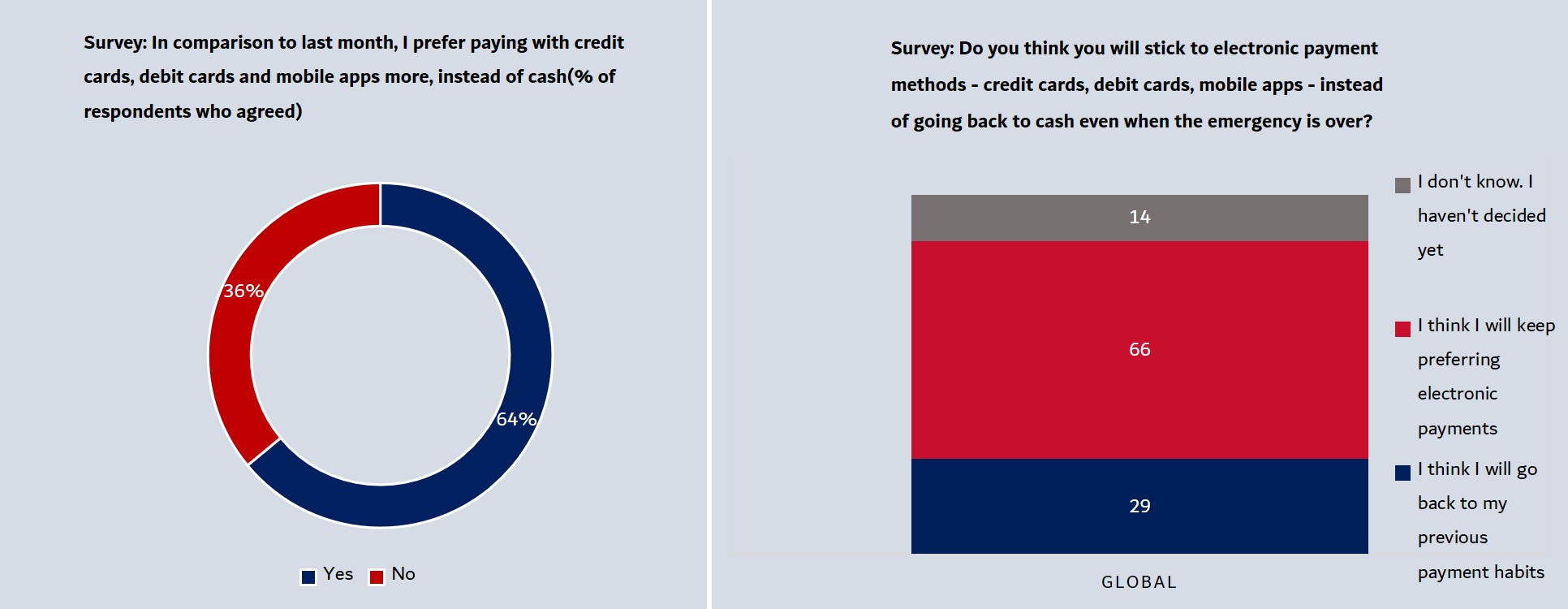

Cash on Delivery (COD) – Another challenge is the preference for COD across all Arab countries accounting for 70-80% of all purchases, in contrast to the rest of the world. This is mainly due to a lack of trust among merchants and consumers when it comes to using regional online payment processes and banking systems. COD may seem convenient to consumers but poses a challenge to the merchants raising failed delivery rates and returns, increasing the cost of business. Even though financial markets and banking infrastructure have been evolving, the development of trusted online payment tools advances slowly. However, the willingness for change on the consumer side is there. As a survey conducted by Visa early 2019 in the UAE indicates that 92% of those consumers who favor COD would pay by card if a mobile “point of sale” (POS) payment option was available on delivery. In addition, the COVID-19 pandemic has also led to an increased open-mindedness towards contactless payment when shopping online, being a global trend as survey results show. When asked, around 6 in 10 consumers preferred electronics then (instead of cash) compared to the month before. And consumers who then preferred electronics payments said they likely would retain this preference in the future.

Source: Visa

Hence, for now, e-commerce companies selling in MENA need to have the capability to accept COD while investing resources in implementing fraud prevention, mobile payment options and monitoring processes to inspire confidence in customers to shop online without any inhibitions.

Last mile - The most crucial link of e-commerce is last mile delivery since the online transaction turns into offline with the physical delivery of the order. Based on research, customers mostly express frustration about delivery delays and lack of lead time visibility. Short delivery time expectations demand a lot from e-commerce companies and due to infrastructure challenges like the absence of street addresses in some MENA countries, delivery times are impacted. According to venture capitalist firm Mavericks, last-mile delivery failure rates range between 15% in the UAE to 40% in Saudi Arabia leading to poor customer satisfaction and lost revenue due to the customers’ preference to pay COD. To tackle this logistical challenge, conveniently located fulfilment centre(s), real-time monitoring of shipments and advanced technology is needed. Handling last-mile logistics efficiently is a clear competitive advantage in the MENA e-commerce industry.

Conclusion

Business ties between China and the MENA region have been strengthening with China increasing its investments and business activities across the region. One area increasingly attracting Chinese investors and companies is MENA’s boosting e-commerce sector which is developing fast and will still significantly grow in the years to come. Due to a lack of local manufacturing and retail businesses going online, opportunities for cross-border e-commerce players are promising. There are numerous well established e-commerce marketplaces in the region helping foreign sellers to enter the market without major investments. However, moving products across borders and delivering them on time in a foreign region presents challenges. Careful consideration of those huddles and a solid supply chain management set-up are crucial to overcome these difficulties. Therefore, finding the right logistics partner with the needed experience, network and expertise can facilitate the new market entry enormously.

At RSA Global, we provide professional end-to-end logistics services for Chinese cross-border e-commerce companies comprising (express) import and export by air and ocean freight, customs clearance (B2B/B2C), fulfillment, (cross-border) distribution within the region, last mile delivery, COD, and VAT registration if required. We also belong to Amazon’s Service Provider Network (SPN) offering Amazon sellers in China exclusively global cross-border logistics services. A close network of reliable partners enables us to ensure efficient and timely transportation of goods across borders and to remote areas. By regularly evaluating our partner’s service portfolios and performance levels, we can offer the most suitable and cost-efficient end-to-end solution for your product. And as we know how important it is to have full visibility and the right information at the right time throughout the e-commerce eco-system, technology and digitalization belong to our priorities. We have developed our in-house digital Click Eco-System aiming at digitizing 100% of our customers’ interactions with us. It comprises the transport management system ClickRF (Click for your Road Freight), the freight management system ClickSC (Click for your Supply Chain) and the warehouse management system ClickWM (Click for your Warehouse Management). Supported by RSA’s voice-enabled intelligent Assistant RiA carrying out administrative tasks on behalf of the user, these systems significantly simplify and accelerate our customers’ supply chains.

Hence, with our team of e-commerce logistics experts, global network of fulfillment centers and partners as well as employed technology infrastructure, we are here to advice you on your specific e-commerce supply chain strategy and work out a suitable solution making sure to keep your supply chain efficient and your customers happy. Investing in a logistics provider that will match your needs is probably the best investment you can make over time to reach new heights with your e-commerce website.

For more information and specific enquires you can reach out to our “General Manager – China” Zhen Peng who overseas our business operations in China and between China and the Middle East by LinkedIn or by filling our contact form here. With 15 years of experience in the supply chain and e-commerce industry being based in China and the Middle East, Peng has the right expertise to advice you regarding your China-MENA shipments.