Media

Suez Canal “Traffic Jam” – Business implications and supply chain alternatives

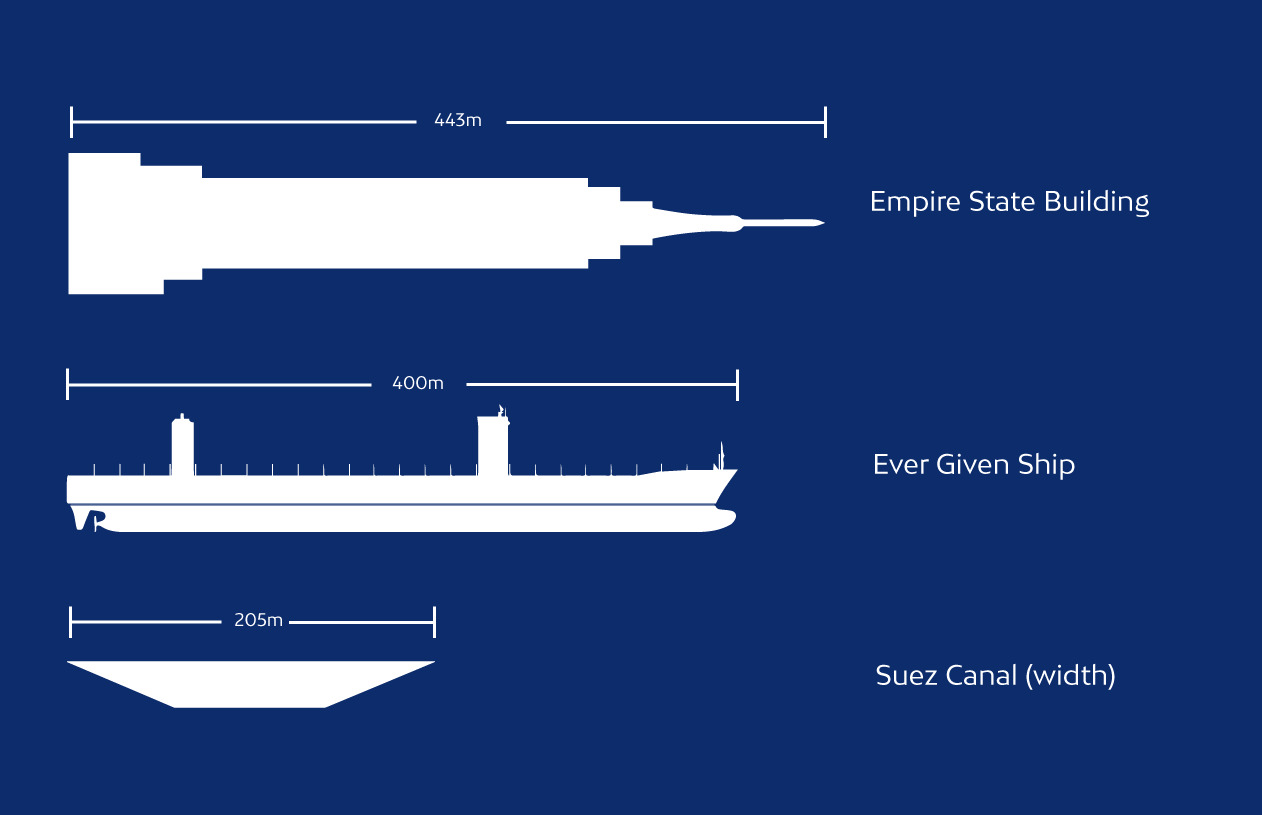

The recent “traffic jam” in the Suez Canal is indeed a disruptive event that affected 12% of global trade for crucial shipments like oil and gas, livestock, automotive, retail goods and other raw supplies for manufacturing companies in Europe. Stormy weather set the skyscraper sized Ever Given vessel off its course from the Red Sea to the Mediterranean pushing the ship diagonally, wedging on both banks of the canal, essentially blocking the canal and, consequently, the shipping traffic running through it.

By now, the vessel has been successfully refloated and is back on its course to Rotterdam, Netherlands after a week-long of push-and-pull, excavating and dredging efforts with a bit of elemental help from the high tide. But despite the ship getting unstuck and moving again, the disruptive footprint it has brought to the global economy is still very much visible.

Comparison in width and height of the Suez Canal, the skyscraper sized vessel and the Empire State Building.

What is the role of the Suez Canal in the global supply chain?

The Suez Canal is a man-made waterway that is being controlled and managed by Egyptian government authority. It is one of the world’s most vital shipping lanes accommodating at least 50 ships per days, or 1.2 billion tons of cargo ranging from consumer goods, livestock, oil and gas and many others. The canal’s blockage held up a staggering $9.6bn of trade per day.

The Suez Canal connects the global trade between Europe and Asia. This canal is the most efficient link for transporting Europe’s consumer demands for crude and oil from the Middle East, clothing materials such as cotton from the Indian peninsula and auto spare parts from East Asia. This route is the fastest and most cost-effective way in comparison to going 6,000 miles farther through the Cape of Good Hope in Africa with transit time lasting up to 24 days compared to the 16 hours through the Suez Canal.

Other major maritime chokepoints

Global shipping routes are essentially endless but there are a few main chokepoints or narrow channels that connect larger bodies of water along the widely used shipping routes, Suez Canal being one of them. These lanes accommodate the transport of some of the most vital consumer goods from and to the world’s largest markets.

Panama Canal

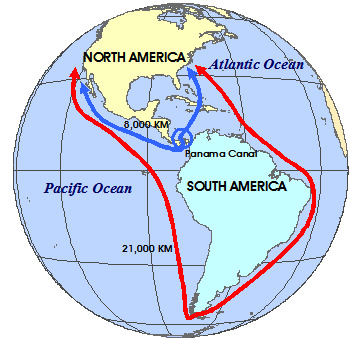

The Panama Canal is one of the busiest shipping lanes in the world connecting the Atlantic and Pacific Ocean. What is so great about this channel is that it cuts the transit time of ships that would normally take the Cape Horn route at the southernmost part of South America before the completion of the Panama Canal. It has been expanded in 2007 until 2015 to accommodate larger ships by widening the canal and deepening the lanes to allow passage for larger ships.

Source: http://travellittleknownplaces.com/

Strait of Malacca

The Strait of Malacca is the world’s second busiest water channel that links major markets in Asia like India, China, Japan, Indonesia, Malaysia, Singapore, Taiwan, and South Korea.

The economic implications of this blockage

As the Suez Canal is one of the major and busiest waterways for global trade, the slightest delays can cause large amounts of congestion and a major disruption in international trade, according to analysts. There are many industries that have been affected by this blockage, mainly the global energy sector. Supplies from the Middle East to Europe and North America have been delayed, causing a significant surge of up to 5% in oil prices since the blockage incident. This is not only due to the supplies stuck aboard the Ever Given vessel, but also caused by 53 tankers that were waiting on either side of the vessel. Experts have concluded that the delays will ripple to other schedules and global markets, an impact that could last for months.

With more than $9 billion worth of goods passing through the canal every day, the losses that have been accumulated were priced at $400 million per hour. Aside from the oil and gas industry, production in Europe is also expected to become temporarily idle . Some of the goods aboard more than 150 other vessels which were waiting to continue their journey through the canal are essential manufacturing raw materials for automotive, electronics and textile. Operations running a just-in-time strategy might be stopping the conveyor belts while they wait for the arrival of their containers and materials. Another factor that multiplies the effects of supplies’ delay is the outpouring of COVID-19 buying needs.

The strategic move

Given the uncertainty of the situation, rerouting around Cape of Good Hope might sound like a good option – only that it adds at least an additional week in transit, translating to additional fuel costs.

The anticipated delays are sure to reverberate up to the ships that are still yet to leave their origin, be it in Asia, Indian Peninsula or the Gulf. So, another strategic alternative would be to use a combination of sea-air cargo solutions which some of our RSA Global customers have opted for during the week-long dilemma. In time-sensitive cases like this, air cargo is the most efficient option. Comparatively, air freight is more expensive that sea freight but it offsets the delay caused by the blockage or the additional transit time and fuel costs of rerouting via a longer waterway (such as Cape of Good Hope).

Below we illustrate the wide air freight networks that we have established at RSA Global. Using these networks, shipped goods can be rerouted in a faster manner using either multimodal solutions of sea-air or directly sending shipments via air if they were not sailed yet.

Another alternative that many businesses and some economies like China are turning to right now is nearshoring. Nearshoring means transferring business operations closer to the end consumer allowing businesses to provide the quickest possible service to consumers, especially for operations following a Just-in-time system. During delays in the supply delivery, a continued workflow, reduction in cost and risk are ensured given that the manufacturing and supplies are closer to the market.

Learn more about our sea-air and air freight networks and let us design together the best solution for your supply chain requirements. Contact our air freight forwarding expert, Rizwan Kareem: Rizwan.kareem@rsa.global to learn more about our resilient supply chain solutions.