Media

Logistics – the cornerstone of MENA’s fast-growing e-commerce market

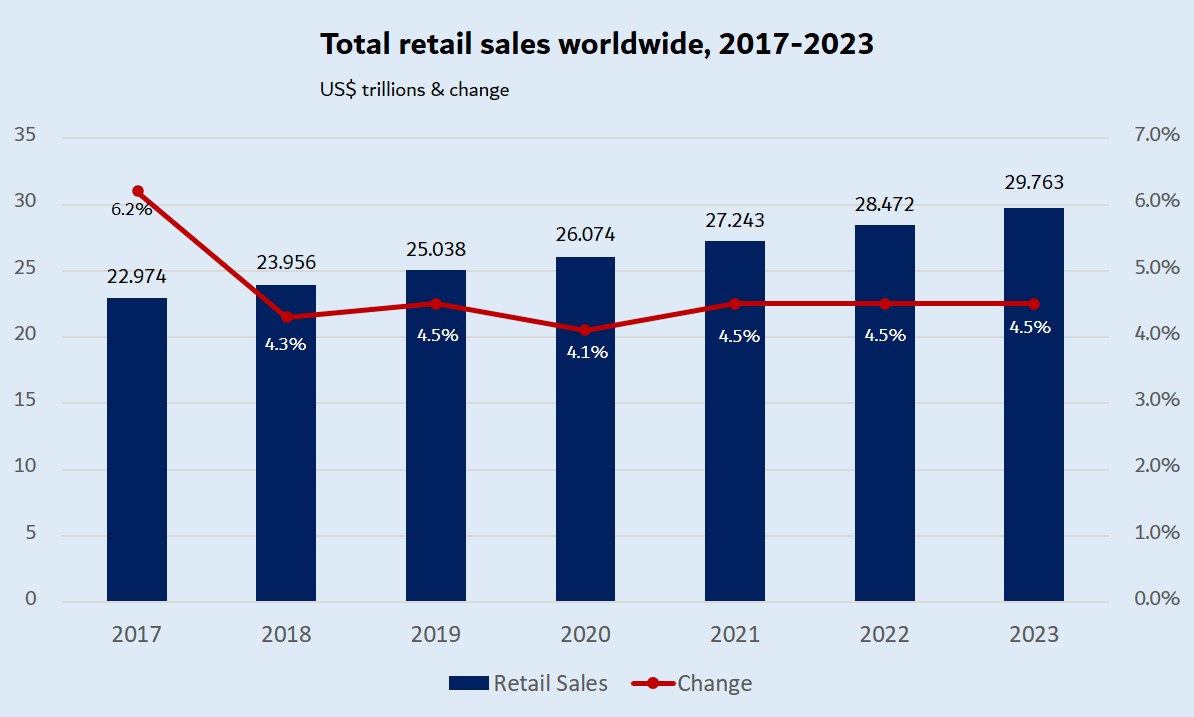

E-commerce has been a buzz word for the last couple of years and latest since the COVID-19 outbreak early this year, nearly everyone seems to have joined the online shopper community. While the global retail market has been slowing down since 2017, worldwide e-commerce sales is growing at a rapid pace having reached US$3.5 trillion in 2019, a yearly increase of approximately 18%, due to a Shopify report.

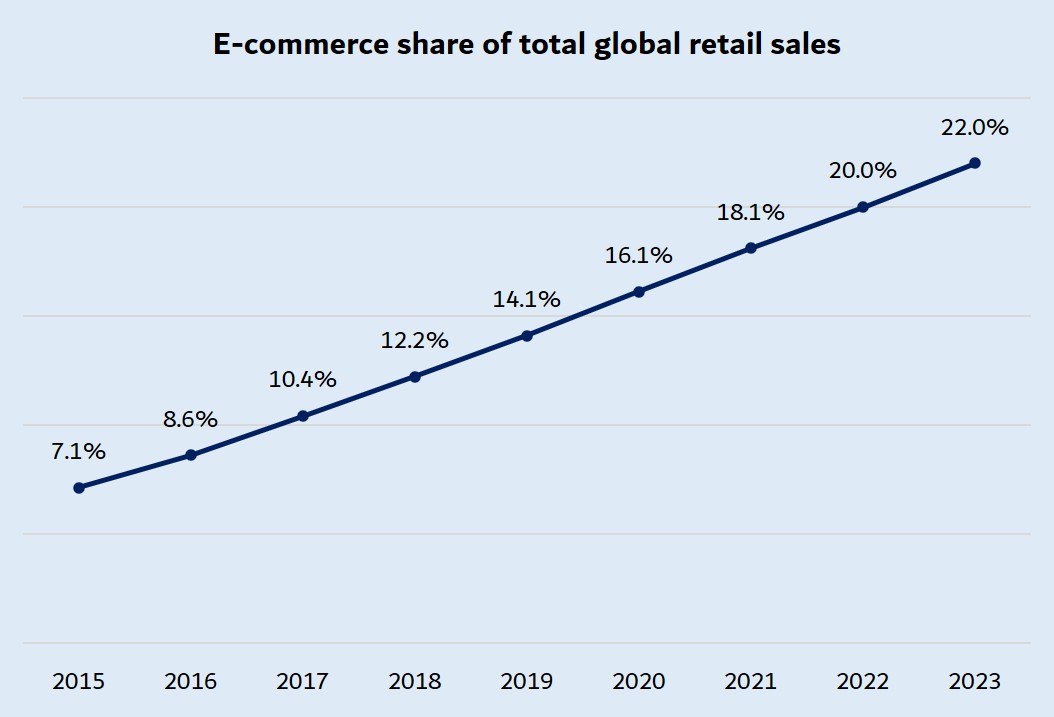

By 2023, e-commerce is expected to nearly double to more than US$6.5 billion. These growth predictions combined with the fact that e-commerce nevertheless only represents 14.1% of today’s total global retail sales, clearly shows the industry’s huge development potential retailers cannot afford to ignore.

Source: eMarketer

Source: Statistika

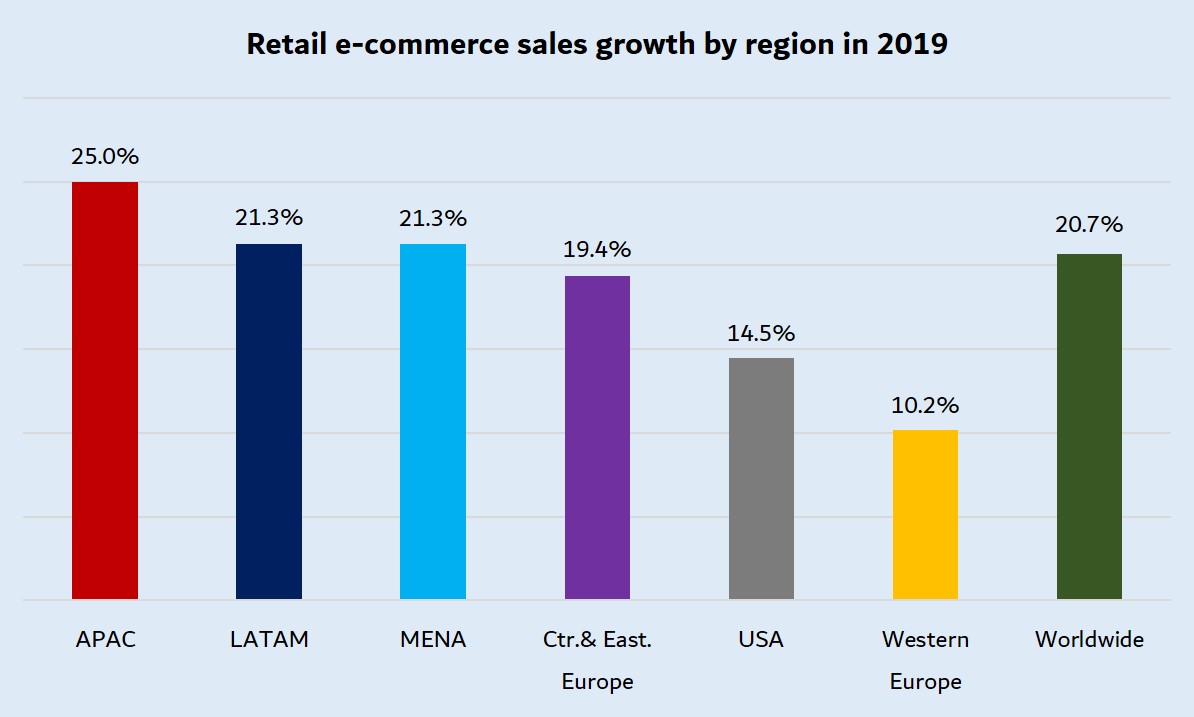

While the Western world used to be the center of e-commerce, this has changed. Today, the three fastest growing regions in terms of e-commerce are Asia Pacific (APAC – 25% yoy), Latin America (21.3% yoy) and Middle East & Africa (MENA – 21.3% yoy) with China being the clear leader holding an incredible market share of 54.7%. However, considering that digital business activities in the MENA region only started after 2010 with e-commerce strategies picking up a few years later, due to Bain & Company, it is astonishing that MENA belongs to the current fastest growing e-commerce markets bringing a lot of opportunities for retailers, wholesalers, manufacturers and their suppliers.

Source: eMarketer

This article takes a closer look at the current and future development of MENA’s e-commerce market examining which segments have most growth potential moving forward and how COVID-19 has been impacting that development. In addition, it will unfold the numerous opportunities the e-commerce market creates for its players as well as the logistics requirements needed to successfully run and grow an online sales business. By doing so, the article showcases why an efficient logistics infrastructure is indispensable and cannot be underestimated by any e-commerce business.

MENA’s e-commerce market development

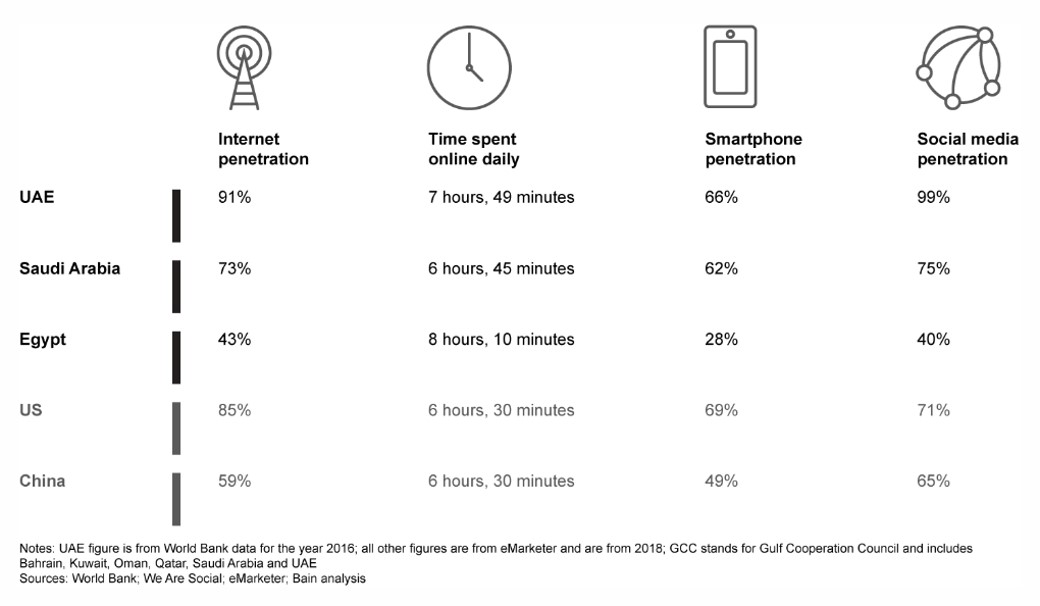

While MENA’s e-commerce sector was worth US$8.3 billion in 2017, it is expected to more than triple by 2022 reaching US$28.5 billion, a yearly growth rate of more than 28%, according to Brian & Company. Interestingly, even though the growth figures are sky rocking, online sales in MENA still only equal 2-3% of total retail revenue with the United Arab Emirates (UAE) being the most advanced e-commerce market having a penetration rate of 4.2%, followed by the Kingdom of Saudi Arabia (KSA) at 3.8%, and Egypt at 2.5%, due to Go-Gulf. On the other hand, the UAE and KSA have some of the highest levels of Internet, smart phone, and social media penetrations globally, while Egypt has one of the highest levels of time spent online. Furthermore, the UAE hosts one of the highest spending online community willing to shop online for an average amount of US$450 annually. Hence, given the fast growth of e-commerce in MENA but its relatively low retail market share paired with the region’s high internet penetration rate, the potential of e-commerce in MENA is obvious. Digital savviness will logically boost e-commerce activities as people frequently using the internet regularly amplify their areas of usage.

Internet penetration rate in MENA

E-commerce opportunities for retailers in MENA

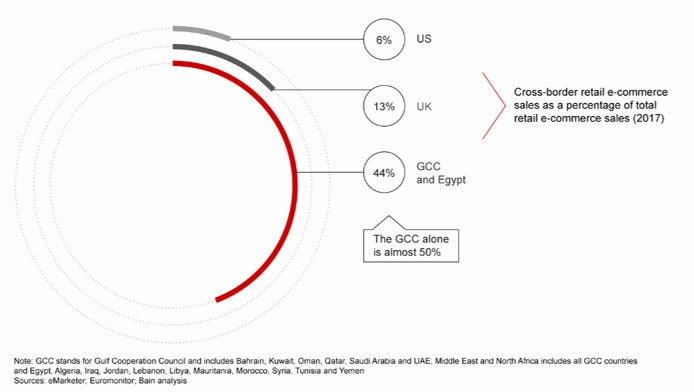

In addition to the above-mentioned favorable market conditions, the opportunities for retailers, wholesalers and manufacturers operating in the MENA market are numerous when taking a closer look. For example, studies show that only less than 20% of top global fashion brands physically present in MENA have locally based e-commerce platforms that offer delivery to the regional consumer. As a result, imports to the GCC region remain high due to a supply gap of popular products. While this demand-supply imbalance creates opportunities for cross-border e-commerce players being based outside MENA, currently representing around 45% of the market in the GCC, it should further encourage local players and retailers to close that gap with own service offers and solutions.

Another particularity of MENA’s e-commerce market playing in favor of online sellers is its high fragmentation. While the top two e-commerce players capture between 25% (UAE) and 36% (KSA) of a specific market, in most other countries that is typically more than 50%. By having the major companies not dominating most of the market, more parties have the chance to acquire market share.

Most popular e-commerce segments

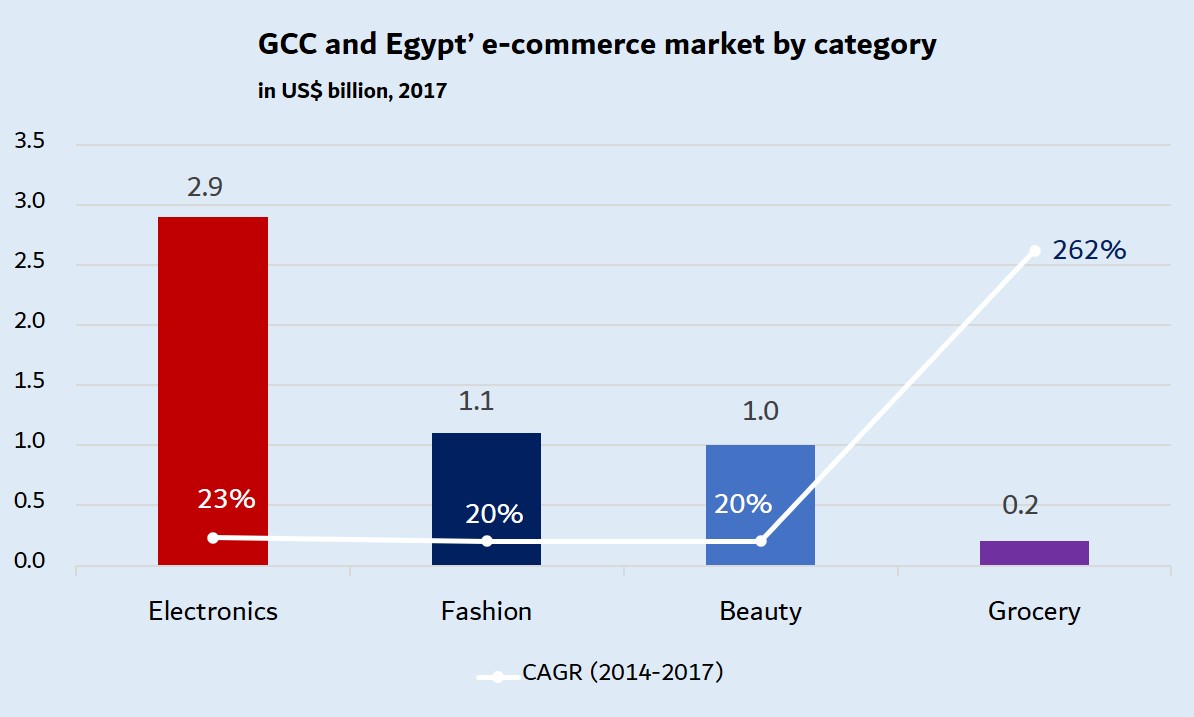

When evaluating e-commerce opportunities, it is crucial to look at the performance of different e-commerce segments. For MENA it stands out that electronics, fashion, beauty, and grocery comprise 80% of the e-commerce market with significant room for growth across all categories when comparing to mature e-commerce markets, according to Go Gulf. At US$ 2.9 billion and an annual growth rate of 23% over recent years, electronics is the largest e-commerce category in GCC and Egypt. Beauty/personal care is the second highest penetrated category with an e-commerce market size of around $1 billion and a growth rate of 20% in GCC and Egypt.

Source: Bain & Company

But while electronics and beauty/personal care have penetration levels like those seen in developed markets, fashion, and grocery lack behind. However, grocery is the fastest-growing e-commerce category worth $200 million (<1% of ecommerce market) in GCC and Egypt and has been growing at 250% during recent years. Despite the exponential growth, grocery remains the least penetrated retail category, with estimated 4% of total sales by 2022. Nearly 60% of the region’s grocery shoppers have never purchased groceries online which again shows the huge potential for growth. The UAE is the country most comfortable with online food delivery, accounting for 4.8% of the grocery market, almost 5% of the grocery market in UAE is e-commerce, due to Go Gulf.

COVID-19’s impact on e-commerce growth

As it turns out, a clear trend towards e-commerce has been arising in the MENA region since 2010. On top of that, the shift towards online has recently experienced an unexpected sharp boost due to the global outbreak of the corona virus (COVID-19). As the pandemic forced malls and stores to close and people to stay at home temporally, e-commerce penetration increased dramatically compared to pre-COVID times. Many consumers changed their shopping behavior during the pandemic, as a regional study including 10 MENA countries shows. Up to 40% of the respondents said they shop online more often than before the COVID-19 outbreak. And 48% in the UAE and 69% in KSA replied they would maintain their current shopping behaviors after the pandemic. By looking at some real examples and figures, the drastic change in shopping behavior during COVID-19 can be better understood. Daily volumes of some of MENA’s largest e-commerce players in April-May 2020 were 1.5 times that of January-February 2020. Dubai-based Majid Al Futtaim (MAF), operating 24 malls, has recorded a 59% year-on-year increase in online customers in March 2020. And the online sales of Saudi Arabian retailer BinDawood Holding has seen a 200% increase since the escalation of the virus.

Consequently, for retailers, wholesalers, manufacturers, and suppliers who have not yet embarked on the digital transformation prior to the disease’s outbreak, COVID-19 should have been a wake-up call to quickly catch up with the online trend. Those who fail to recognize the need for transformation and adopt accordingly might fall behind the competition and disappear from the market at some point.

The key role of logistics in e-commerce

Once the decision to move sales online is made, many aspects need to be considered to operate a smooth e-commerce business meeting the customers’ ever-increasing expectations. One of them is the set-up of an efficient logistics infrastructure. This is crucial to any e-retailer’s success as customers request to receive their orders within a few days. Moving products at high speed requires solid supply chain management which is why logistics is often described as the cornerstone of e-commerce. Companies with inefficient supply chains can expect to lose business. Thus, in the following, we will look at key e-commerce logistics requirements and why their professional execution is highly important to a well working online business.

First mile – First mile is the first step of the e-commerce supply chain transporting the goods from the seller or manufacturer’s location to a fulfillment center/warehouse or transportation hub such as airport. First-mile together with last-mile deliveries are considered as the core of the e-commerce supply chain process. Consequently, you must pay extra attention and work on ways to make these processes as seamless as possible for faster deliveries and maximum fulfillment while keeping shipping expenses low.

Fulfillment/warehouse – The rapid speed of e-commerce requires different warehouse infrastructure and management than traditional supply chains. Reduced order sizes, greater frequency of picking and packing and quicker replenishment mean that available warehouse areas to be utilized more effectively. The three main features of an intelligent e-commerce warehouse are visibility, mobility, and flexibility. The increased volume of single-item orders requires the use of software solutions such as warehouse management systems (WMS) and barcode technology. WMS systems use sophisticated automation tools assisting with streamlining warehouse space and activities which enable the business to deliver orders on time. Barcodes allow to track all activities happening inside a fulfillment facility such as receiving, replenishment, packing, shipping, returns and labor-tracking. Without implementing a smart warehouse design and technology, capacity issues, inadequate storage and a productivity drop might be faced negatively impacting customer experience.

Last mile - The most crucial link of e-commerce is last mile delivery since the online transaction turns into offline with the physical delivery of the order. Based on research, customers mostly express frustration about delivery delays and lack of lead time visibility. Short delivery time expectations demand a lot from e-commerce companies and due to infrastructure challenges like the absence of street addresses in some MENA countries, delivery times are impacted. According to venture capitalist firm Mavericks, last-mile delivery failure rates range between 15% in the UAE to 40% in Saudi Arabia leading to poor customer satisfaction and lost revenue in a country where most customers pay cash on delivery. To tackle this logistical challenge, conveniently located fulfilment centre(s), real-time monitoring of shipments and advanced technology is needed. However, handling last-mile logistics efficiently is a clear competitive advantage in the e-commerce industry.

Return logistics – Research shows that customers return up to 30% of their online orders. This means that returning goods from their destination to their point of origin, called reverse logistics, must be provided as well increasing the need for logistics. Growing expectations of replacement or refund of returned products is a huddle e-commerce companies need to deal with and strengthening own reverse logistics channels can only be beneficial. Keeping a scope for managing incoming inventory at the fulfilment centre and quicker replacements are key to handling returns well.

Conclusion

Concluding, it can be said that MENA consumers seemed to have few reasons to move their purchases online initially. Limited product availability, unreliable shipping times and service levels have damped the rise of e-commerce in the region. Recent e-commerce growth figures, however, have ushered in the beginning of a new chapter in MENA e-commerce. So, e-commerce players and those “to be” should be mindful to not stay behind the rapid upwards trend. But in order to succeed in today’s competitive e-commerce arena, e-retailers must have the capacity to meet the increasing customers’ expectations directly linked to the efficiency of one’s e-commerce supply chain. All described logistics steps require professional logistics management which can be established in-house but will require a huge amount of effort and investment which normally only major e-commerce players can afford to do. For all other players, it makes sense to fall back on professional logistics service providers benefiting from their expertise in running e-commerce logistics operations, available technology set-up and established networks resulting in efficient processes, faster growth, and cost savings for the company. And the best of all, while the experts take care of all logistics needs, business owners can dedicate their time to what really matters to them, further improve and develop their product.

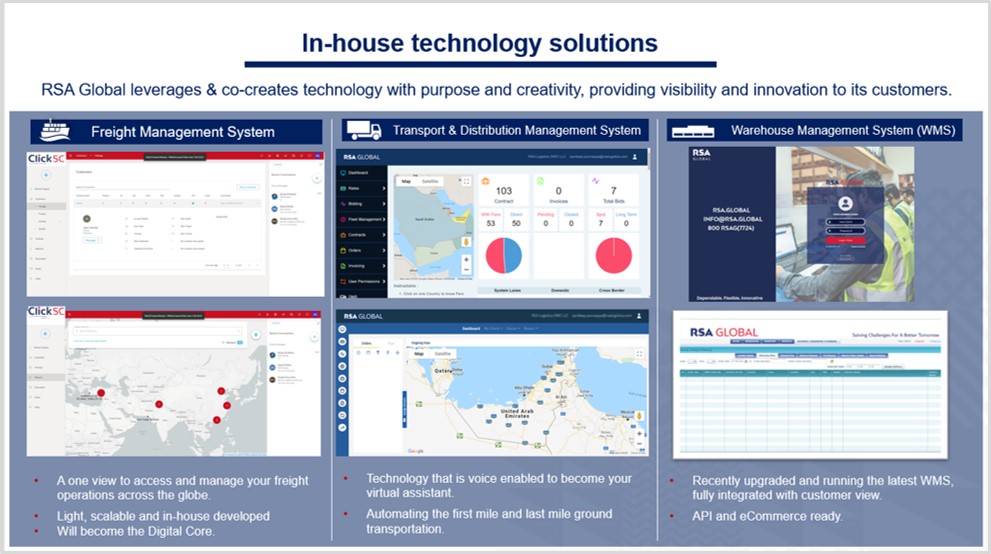

At RSA Global, we provide professional end-to-end logistics services for the e-commerce industry including first mile, fulfillment, cross-border shipping, document provision, customs clearance, last mile as well as reverse logistics. We belong to Amazon’s Service Provider Network (SPN) offering Amazon sellers in the UAE and China global cross-border logistics services. A close network of reliable partners enables us to ensure efficient and timely transportation of goods across borders and to remote areas. By regularly evaluating our partner’s service portfolios and performance levels, we can offer the most suitable and cost-efficient end-to-end solution for your product. And as we know how important it is to have full visibility and the right information at the right time throughout the e-commerce eco-system, technology and digitalization belong to our priorities. We work with the latest management software systems which can be easily integrated with any in-house systems providing full visibility along the entire e-commerce supply chain. Our voice-enabled Transport & Distribution Management System (TMS) gives transparency of first and last mile transportation, our in-house developed Freight Management System (FMS) lets you view and manage your global freight operations digitally, while our recently updated state-of-the-art WMS helps to efficiently control and manage your day-to-day fulfillment operations. Receiving real-time data will significantly help to take the right decisions quickly and optimize the quality of our e-commerce services continuously.

Source: RSA Global

Hence, with our team of e-commerce logistics experts, global network of fulfillment centers and partners as well as employed technology infrastructure, we are here to advice you on your specific e-commerce supply chain strategy and work out a suitable solution making sure to keep your supply chain efficient and your customers happy. Investing in a logistics provider that will match your needs is probably the best investment you can make over time to reach new heights with your e-commerce website.

Contact us here to discuss your e-commerce requirenents!