Media

Key highlights, industry news, insights, and expertise around the world of logistics

Packaging of Chemicals. What is it about? The rise of product repacking...

What comes to your mind when hearing of packaging? The packaging paper of your favourite chocolate bar, cans containing soda drinks, mailing pack carrying your favourite fashion item or just the well-designed box containing facial tissue papers? Right, these and many other forms of packaging including cartons, bubble wrappers and containers in all forms and sizes (paper, paperboard, plastics, metal, glass) make up the scope of packaging materials. Packaging has been one of the most ancient methods of preservation and transportation of products from one point to the other. It also serves as means of product identification as well as for product protection.

The packaging industry has witnessed steady growth over the years adding value to the global economy. In the UAE alone, the packaging industry is estimated to grow at 5% CAGR between 2020 - 2025 according to Mordor Intelligence. Globally, the packaging industry generates $900 billion in annual revenue according to Mckinsey. The projected demand for packaging materials will likewise reach $1.05 trillion by 2024 as revealed in a study by Smithers.

Packaging materials in the chemical industry

Packaging materials are likewise manufactured from chemical components for example Low-Density Polyethylene (LDPE) used for food packaging containers and Polycarbonate (PC) also used mostly in recyclable bottles.

Notably, packaging in the chemical industry however takes on different forms than we are used to. In this industry, packaging is fabricated for extensive industrial usage such as in the transportation, storage of hazardous chemicals and food grade liquids like drinks and edible oil. This sector, commonly known as bulk container packaging market, is expected to reach a value of $ 6.5 billion by 2025 growing at CAGR of 9.87%, according to a study by Mordor Intelligence. In 2019, the industry recorded a value of $3.65billion. Acumen Research and Consulting also attributes growth in the bulk container packaging industry to the ever-changing consumer preferences, technological developments, growth in emerging markets, amongst others. They project a 10.5% increase in profits within the Asian Pacific market by 2026.

Current market situation and its impacts

Earlier this year, the world was hit by a pandemic, the SARS-CoV-2(COVID-19) virus. This further led to major economic downturns. Many industries have been suffering great loses due to halts in most businesses and trade activities as a result of social distancing and earlier lockdowns enforced by governments around the world to flatten the curve of SARS-CoV-2(Covid-19) infections. But as the saying goes, every bad situation brings something good, which has been the case for most sectors like packaging (bulk packaging) witnessing a surge in productivity and profits partly due to increasing demand from the pharmaceutical sectors and increase in consumption of packed products. Consequently, the European bulk packaging, for instance, is experiencing an accelerated growth. An analysis by Technavio assessing Europe’s Bulk Packaging market in 2020 projected a CAGR of over 1% y-o-y, a growth of $0.73 billion between 2020-2024, a positive trend even in times of economic hardship.

In new developments and after several months of research and development, top pharmaceutical companies with the aid of innovative technologies have announced a breakthrough in the development of a COVID-19 vaccine. The vaccines which are presently undergoing late-stage clinical trial could be ready for public usage as early as December 2020 according to new reports.

As pharma companies close in on the time to get an effective vaccine to the market for mass usage, the chemical industry on the other hand is bracing up to support in large volumes raw material from chemicals and petrochemicals needed in the production of the vaccine for global usage alongside other hygienic products such as detergents, sanitizers, protective equipment, disinfectants and other essentials required for combatting COVID-19. This has further driven producers, manufactures, suppliers and distributors in the chemical industry to work round the clock to ensure availability of these chemical products for manufacturing and end usage. “In the current crisis, the role of the chemical industry in ensuring the steady and reliable supply of vital raw materials and products has never been more pronounced. As medical facilities in the region are starting to feel the strain from the pandemic, businesses are continuing to manufacture, in difficult circumstances, the various tools, safety equipment and personal protective equipment such as sterile gloves, masks, hand sanitizers and protective clothing urgently needed to protect the health and safety of people and medical personnel,” stated Dr. Abdulwahab Al-Sadoun, Secretary General, GPCA in a recent GPCA report.

As these raw chemical products are moved from one point to another in the supply chain, you normally do not get to see the modes/units in which they are stored and transported which brings us back to where we started, packaging.

The following paragraphs will underline the commonly used packaging units by producers, suppliers, and distributors within the chemical industry.

The various packaging types in the chemical industry

In the chemical industry, packaging is a key component for chemical handling and safety. These packaging are tailor-made considering the classification of the products being transported, distributed, or stored. Without proper packaging of chemicals (bulk liquid), the risk of incidents and real danger to people’s safety and material protection becomes high including product and asset damages as well as fatalities in the cases of fire explosions.

Due to the imminent degree of danger caused by wrong product mishandling/packaging, the United Nations (UN) Committee of Experts on the transport of dangerous goods has established three categories of packaging for all dangerous and non-dangerous chemicals. These categories include:

1. X - Packing Group I: for substances with potentials of causing high danger.

2. Y - Packing Group II: for substances with potentials of causing medium danger.

3. Z - Packing Group III: for substances with potentials of causing low danger.

Following the packing groups, the committee established a new (UN marking system) which provides details on the level of quality each packaging unit possess in addition to the nature of chemicals due to its hazardous traits.

The IMO/ILO/UNECE Code of Practice for Packing of Cargo Transport Units further outlines guidelines for dangerous goods handling. Section 10.3.2 states that “Cargo Transport Units (CTUs) should be packed so that incompatible dangerous or other goods are segregated in accordance with the rules of all modes of transport. In some instances, even goods of the same class are incompatible with each other and should not be packed in the same unit, e.g., acids and alkalis of class 8." Section 10.3.5 also states that “Packages should be handled and packed in accordance with their markings (if any).”

Provisions on dangerous good packaging by ADR European Agreement concerning the International Carriage of Dangerous Goods additionally expresses the importance of selecting the right packaging. Subsection 4.1.1.2 states "Parts of packaging’s, including IBCs and large packaging’s, which are in direct contact with dangerous goods:

a. shall not be affected or significantly weakened by those dangerous goods.

b. shall not cause a dangerous effect e.g., catalysing a reaction or reacting with the dangerous goods; and

c. shall not allow permeation of the dangerous goods that could constitute a danger under normal conditions of carriage.”

The IATA Dangerous Goods Regulations (IDGR) Packing Instruction 650 also highlights the importance of quality in any packaging material. The regulation states “packaging must be of good quality, strong enough to withstand the shocks and loadings normally encountered during transport, including trans-shipment between transport units and between transport units and warehouses as well as any removal from a pallet or overpack for subsequent manual or mechanical handling. Packaging’s must be constructed and closed to prevent any loss of contents that might be caused under normal conditions of transport, by vibration, or by changes in temperature, humidity or pressure”.

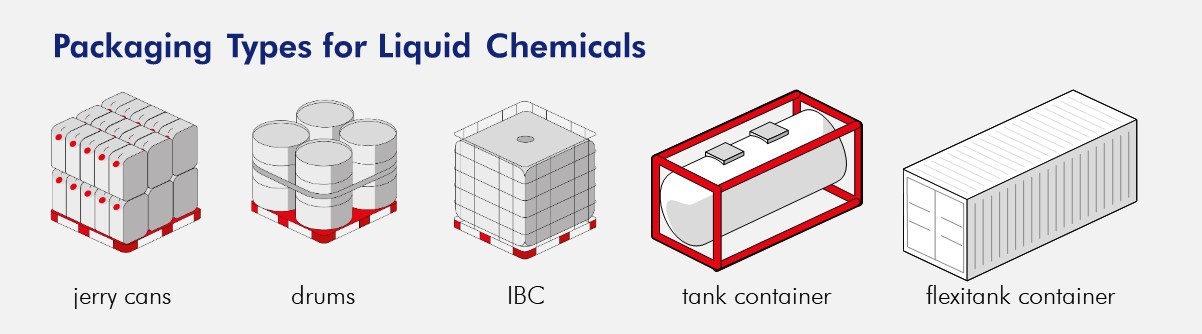

As we have now described the importance of quality and safety in the selection of any type of packaging for chemicals, let us now discuss the common types of chemical packaging focusing on Drums, IBCs, Jerry Cans, Flexi tank containers and ISO tank containers.

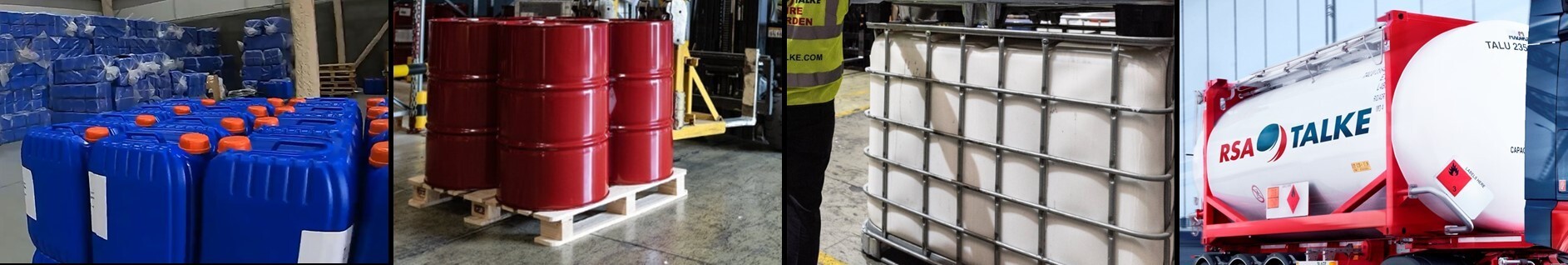

Drums

Chemical drums, also referred to as barrels, are cylindrical shaped containers which comes in either fibre, metals or plastics materials. They are the most attractive products in the bulk container segment and known to be sustainable due to their ability to be reconditioned or reused. Chemical drums have a capacity of approx. 200 litres and are used to store almost all classes of chemicals including pharmaceutical liquids.

Drums are however subject to dents when not properly handled. Rust and cracks lead to leakages and major high-risk incidents. Thus, whenever used they must be handled with caution. Any form of storage must be subjected to thorough conditional checks/assessment. Globally, the drums market is estimated to reach a CAGR of 7.1% between the period of 2017 to 2027 with a market value of $17,684 million, according a report by Future Market Insights (FMI).

Intermediate Bulk Containers (IBC)

Now we move on to Intermediate Bulk Containers, popularly referred to as IBCs. These are specialized units with capacity of holding up to 1,000 litres of liquid substances. These cube shaped containers either made of plastic, metals, or a combination of both are commonly used in handling(storing) dangerous chemicals – classes 3, 4, 5 and 9 and other chemicals such as edible liquids, lubricating and essential oils.

Many have described IBCs as eco-friendly due to their usability and recyclable nature. They are the preferred choice for most supply chain operators and distributors because they are easy to handle by forklifts and efficient for storage purposes. The global IBC market is expected to reach a 6.3% increase, considering the sales of over 596,600 units in 2018, and a market estimation of over $10billlion by the year 2020.

Jerry Cans

Jerry Cans are another secured and reliable medium for bulk liquid/chemicals packaging and transportation. They are specially designed containers that hold up to standard 20 litres (5 gallons) of liquids and come in two forms, steel metal (10 litres) and plastic (5 litres). History reveals that these cans originated from Germany back in the 1930s during the WWII.

The German military used them as a medium of transportation for fuel from one point to the other. Their usage gained global attention when the containers were used by the Americans and subsequently spread across the globe. In modern days, Jerry Cans are used by many chemical producers and distributors as they ensure product safety during transportation in addition to their lightweight options and cost- effectiveness. The manufacturing of jerry cans rose at a value of $2.8 billion in 2018 with plastic jerry cans accounting for 80%. Globally, the Jerry Can market is estimated to reach $4.6 billion by 2027, according the findings from Transparency Market Research.

Flexi tank containers

Flexi tank containers are standard 20ft containers used for shipping bulk non-hazardous liquid such as edible oils. It is estimated that more than 800,000 flexi tank containers were transported in 2017. Flexi tank containers have become the alternative for shippers (transportation) as the tanks can be cost effective.

On the other side, this mode of packaging and transportation is restricted to non-hazardous chemicals and is for one-time usage only making it unsustainable. The flexi tank container market size was estimated at USD 366 million in 2018 and is projected to reach USD 912 million by 2023, at a CAGR of 20.0%. Growth in the global trade of food-grade liquids, non-hazardous chemicals, and pharmaceutical liquids are the major drivers for the flexi tank container market.

ISO tank containers

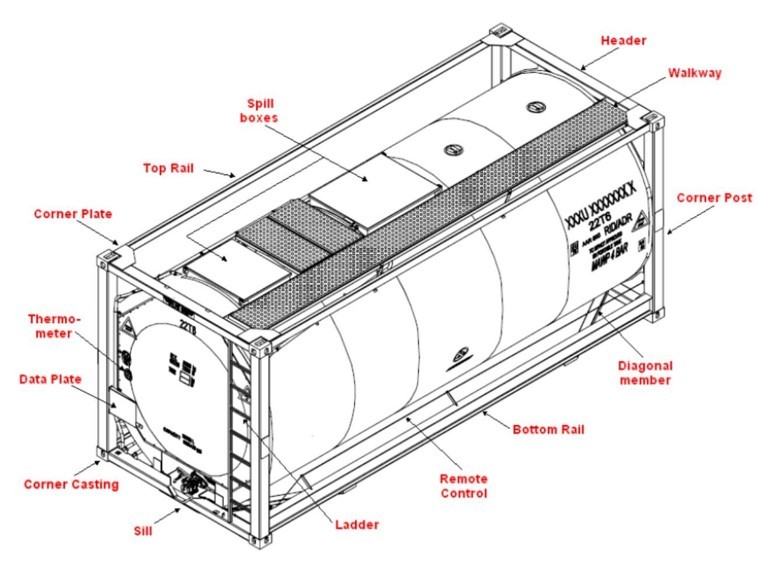

The following paragraphs will be focusing on ISO tank containers and why it is by far the most economical packaging for bulk usage. The cylindrical shaped containers primarily produced from stainless steel with strong metallic layers have gained popularity for most chemical and bulk liquid packaging. This is due to many producers and distributors shifting to the usage of eco-packaging as a solution to waste reduction and therefore opting for the usage of recyclable ISO tank containers. Sustainability is one of the biggest concerns of all global stakeholders. According to the sustainable development goal, no.7 and no. 9 of the United Nations (UN), greenhouse gases and carbon emissions must be reduced to control global warming. The UN report on climate change in 2019 stated that the world must cut GRG emissions by 45% by 2030.

Like every industry, service providers in the chemical industry are also looking for safer and sustainable solutions which aligns with global climatic concerns. Therefore, ISO tank containers are being considered as a cheaper, sustainable, and environmentally friendly substitute for drums and IBCs when it comes to chemical transportation. Our next article will detail the logical groundings as to why ISO tank containers are a better substitute for chemical handling for land and sea freight. ISO tank containers are designed for the storage and transfer of bulk liquids, hazardous, non-hazardous chemicals, and food grade liquids in large volumes. In terms of their benefits, ISO tank containers are increasingly used due to safety concerns including less or no leakages. As of January 1st, 2020, the global ISO tank container market recorded growth of 7.88% y-o-y (652,350 units) compared to 10.81% (604,700 units of tanks) according to a report the International Tank Container Organisation (ITCO).

Conclusion

As disclosed above, packaging in the chemical industry takes on different forms than the usual flexible packaging used in sectors such retail, food, and beverage. The nature and safety concerns associated with these petrochemical and chemical products are the determining factors in selecting packaging units for bulk usage. Consequently, it is important to follow the UN marking system (UN packaging codes) for best suitability. As we conclude, it is also notable that more than one of the above packing units could be used in a single chemical handling process. In the supply chain that means that during the production, storage and transportation of these products to manufacturers, suppliers and distributors most of the chemical products are switched (transferred) from one original bulk packaging to another packaging unit in a process termed repackaging.

This procedure is to facilitate convenience and efficiency in the movement of raw chemical products within and between different markets. Even so, the increasing demand for product repacking in current times (as pharmaceutical companies rely on chemical manufacturers for raw materials in the mass production of medical materials, hygienic products as well as a new COVID-19 vaccine), and rise in localization/nearshoring in different markets, is equally driving an industrial change where most supply chain players are now establishing infrastructures to facilitate seamless and safe material transfers to further enhance flexibility during multimodal transfers and final usage of chemical products. One of such infrastructures is RSA-TALKE’s soon to be launched automated chemical drumming facility for customized chemical material transfers(packaging) located at our integrated chemical hub inside Jebal Ali Freezone Area (JAFZA) Dubai. Stay tuned for more details.